Introduction

Governance tokens are a specialized category of cryptocurrencies that enable holders to participate in the governance and decision-making processes of decentralized platforms and protocols. These tokens empower stakeholders to vote on proposals, influence protocol upgrades, and shape the future direction of blockchain projects through decentralized autonomous governance mechanisms.

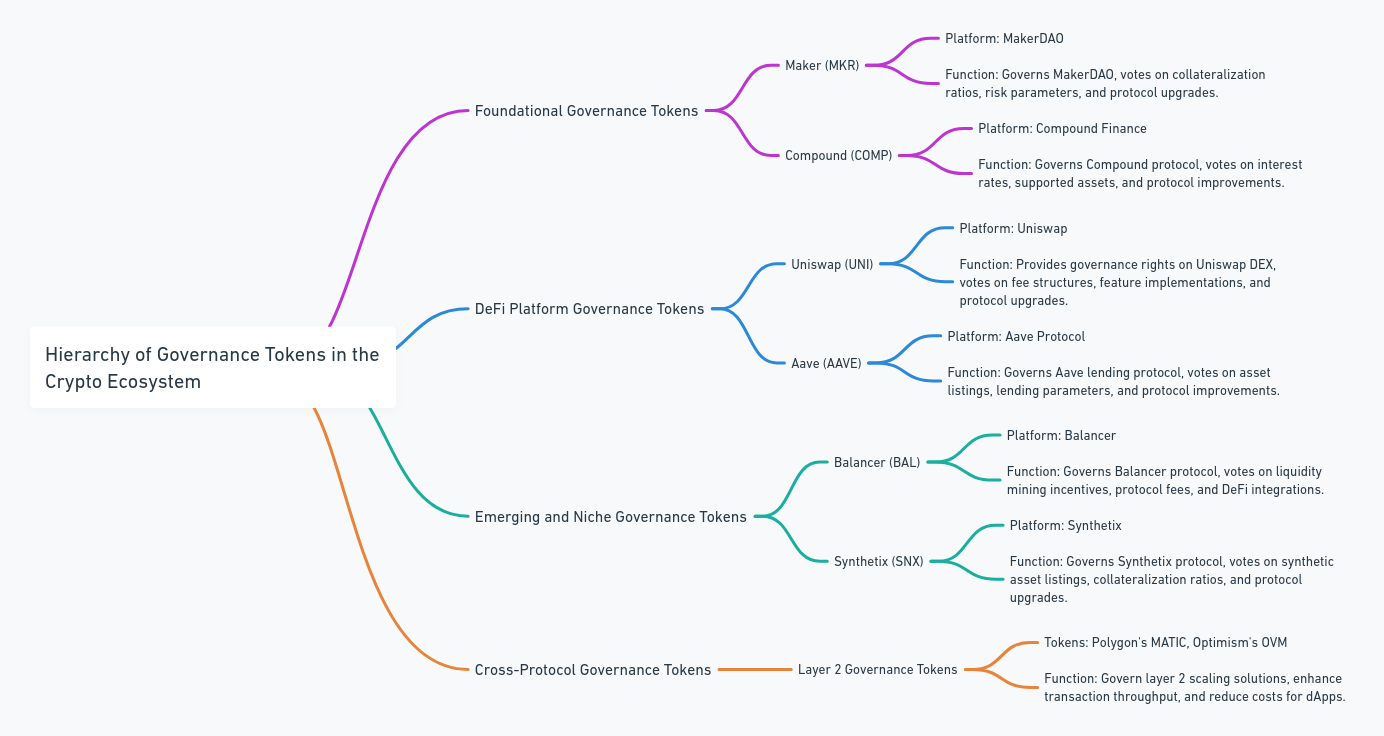

Hierarchy of Governance token

In the crypto landscape, governance tokens form a distinct category that empowers holders with voting rights and influence over decision-making within decentralized platforms and protocols. Here’s an overview of the hierarchy of governance tokens based on their roles, functionalities, and prominence within the crypto ecosystem:

1. Foundational Governance Tokens

These tokens are integral to the governance and operation of major decentralized platforms and protocols, often serving as foundational pillars of decentralized governance frameworks.

- Maker (MKR):

- Platform: MakerDAO

- Function: MKR token holders govern the MakerDAO platform, which manages the decentralized stablecoin Dai. Holders vote on critical decisions such as collateralization ratios, risk parameters, and protocol upgrades.

- Compound (COMP):

- Platform: Compound Finance

- Function: COMP tokens enable governance on the Compound protocol, a leading decentralized lending platform. Holders vote on changes to interest rates, supported assets, and protocol improvements.

2. DeFi Platform Governance Tokens

Governance tokens associated with decentralized finance (DeFi) platforms play pivotal roles in shaping protocol enhancements, risk management strategies, and community-driven governance processes.

- Uniswap (UNI):

- Platform: Uniswap

- Function: UNI tokens provide governance rights on the Uniswap decentralized exchange (DEX). Holders participate in decisions related to fee structures, new feature implementations, and protocol upgrades to enhance DEX functionality and user experience.

- Aave (AAVE):

- Platform: Aave Protocol

- Function: AAVE tokens enable governance within the Aave lending protocol, where holders vote on proposals regarding asset listings, lending parameters, and protocol improvements to optimize liquidity and lending functionalities.

3. Emerging and Niche Governance Tokens

These tokens represent governance rights in newer or niche decentralized platforms and protocols, contributing to innovation and specialization within specific sectors of the crypto ecosystem.

- Balancer (BAL):

- Platform: Balancer

- Function: BAL tokens govern the Balancer automated portfolio management and liquidity protocol. Holders participate in governance decisions related to liquidity mining incentives, protocol fees, and integration with other DeFi platforms.

- Synthetix (SNX):

- Platform: Synthetix

- Function: SNX tokens facilitate governance within the Synthetix protocol, where holders vote on synthetic asset listings, collateralization ratios, and protocol upgrades to support decentralized derivatives trading and asset tokenization.

4. Cross-Protocol Governance Tokens

Tokens that facilitate governance across multiple protocols or interoperable blockchain ecosystems, enhancing coordination and governance scalability within the broader crypto landscape.

- Governance Tokens on Layer 2 Solutions: Tokens like Polygon’s MATIC or Optimism’s OVM governance tokens, which enable governance over layer 2 scaling solutions, enhancing transaction throughput and reducing costs for decentralized applications.

Characteristics of Governance Tokens

- Voting Rights: Holders of governance tokens possess voting rights proportional to their token holdings. They can participate in governance proposals, which may include protocol upgrades, parameter adjustments, funding allocations, and strategic decisions.

- Decentralized Governance: Governance tokens facilitate decentralized decision-making, where the collective votes of token holders determine the outcome of governance proposals. This decentralized governance model aims to distribute power among network participants rather than centralized authorities.

- Incentivization: Governance tokens often incorporate incentive mechanisms to encourage active participation in governance activities. Rewards may include governance tokens themselves, protocol fees, or other forms of incentives to incentivize engagement and long-term commitment.

- Transparency and Accountability: Governance processes conducted through blockchain-based systems are transparent and auditable, ensuring accountability and fairness in decision-making.

Examples of Governance Tokens

- Maker (MKR):

- Platform: MakerDAO

- Function: MKR token holders govern the MakerDAO platform, which manages the decentralized stablecoin Dai. Holders vote on proposals related to collateralization ratios, risk parameters, and protocol upgrades to maintain the stability and efficiency of the Dai stablecoin.

- Compound (COMP):

- Platform: Compound Finance

- Function: COMP tokens enable governance on the Compound protocol, a decentralized lending platform. Holders vote on changes to interest rates, supported assets, and other parameters affecting the protocol’s operation and development.

- Uniswap (UNI):

- Platform: Uniswap

- Function: UNI tokens provide governance rights on the Uniswap decentralized exchange (DEX). Token holders participate in governance decisions such as fee structures, new feature implementations, and protocol improvements to enhance the functionality and user experience of the DEX.

Functionality and Use Cases

- Protocol Upgrades: Governance tokens allow token holders to propose and vote on protocol upgrades and enhancements, ensuring continuous innovation and adaptation to changing market conditions.

- Risk Management: Token holders can vote on risk management strategies, security measures, and financial policies to mitigate risks and enhance the security and stability of decentralized platforms.

- Community Engagement: Governance tokens foster community engagement and decentralized ownership, aligning the interests of stakeholders with the long-term success and sustainability of blockchain projects.

Conclusion

Governance tokens play a critical role in decentralized governance by empowering token holders with voting rights and decision-making authority over blockchain protocols and platforms. They promote transparency, decentralization, and community participation, shaping the governance landscape of the blockchain ecosystem and driving innovation in decentralized finance (DeFi) and beyond.