Home » Case Studies » Gen AI Boosts Profitability in Margin Trading by 40%

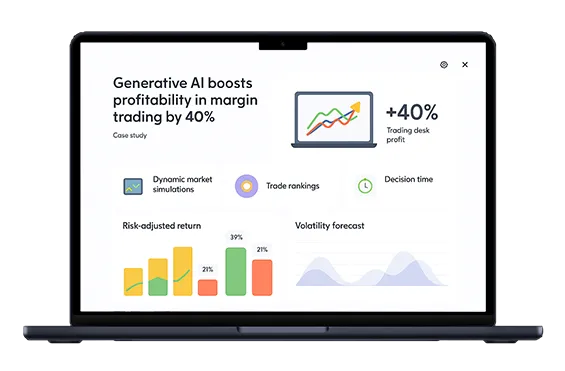

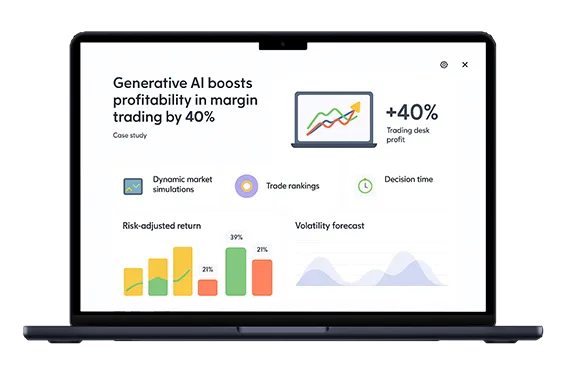

Gen AI Boosts Profitability in Margin Trading by 40%

In just six weeks, our GenAI simulator transformed trade selection for a U.S. brokerage firm, analyzing thousands of scenarios per second to flag the most profitable ones. This shift trimmed decision time by 78%, cut risk exposure, and added $1.8M in monthly margin gains without hiring new analysts.

- ROI < 2 mo

- +40 % Margin Profit

- –78 % Decision Lag

Client Overview

A leading U.S.-based online brokerage serving over 220 000 retail traders partnered with SDLCCORP to enhance their margin trading desk. With 24/6 global coverage and $11.4B in quarterly volume, their desk executes thousands of leveraged trades daily, often under extreme market pressure.

Industry

Retail Brokerage & Margin Trading

Trade Volume

$11.4B in quarterly leveraged trades

Operating Hours

24/6 active desk with follow-the-sun coverage

Staffing

65 analysts, quants, and risk officers

Service Standard

Real-time risk scoring for each position

Quarterly Revenue

$96M from margin trading and leverage fees

Trusted By:

Objectives & Success Criteria

Executives asked for a simple metrics dashboard to track business value in real time. We translated market volatility, compliance risk, and revenue pressure into four critical KPIs. Each metric had a green-goal threshold. If it turned red, we intervened fast and recalibrated.

- Trade ranking: ≥ 85 % risk-adjusted return accuracy; improves position quality and raises daily P&L

- Decision speed: ≤ 500 ms per trade call; cuts lag and allows faster execution in volatile windows

- Risk flags: ≥ 92 % true positive alerts; reduces exposure to margin calls and compliance gaps

- Analyst time: ≥ 30 % workflow reduction; frees staff to focus on strategy and complex cases

We marked the project complete only when all four targets turned green without adding new headcount.

Challenge: Day to Day Pain Points

- Analysts struggled to score fast-moving trades during peak market hours, especially under volatile macro events.

- Each opportunity demanded manual review of 12–15 risk factors, slowing time to action by several minutes.

- Missed trades or delayed entries led to $90k/day in unrealized P&L and reduced desk confidence in model tools.

- Ad hoc flagging created alert fatigue, with 40 % of warnings leading to no action or false escalation.

Our analysts were constantly in reactive mode. By the time we greenlit a trade, the moment was gone.” – Margin desk lead

Market, regulatory, and operational pressures

INRA audits found risk flagging delays during high-volatility events, prompting mandatory improvements. SEC scrutiny on leverage transparency also tightened. Meanwhile, competitors adopted real-time AI scoring to boost profits and mitigate exposure. With analysts overloaded, trade windows missed, and alerts backlogged, our client had to improve ranking accuracy, cut decision latency, and meet compliance benchmarks quickly.

| Metric (Pre-Project) | Baseline Value | Business Impact |

|---|---|---|

| Risk-adjusted ranking accuracy | 61 % | Missed trades and lower P&L on 4.8 positions/day |

| Analyst time per trade decision | 3.8 min | ≈ $90k/day unrealized margin value |

| Alert precision | 68 % | 40 % false flags caused alert fatigue |

| Time to decision | 2.2 min | Late entry during peak volatility |

| Regulatory audit rating | “At Risk” | Noncompliance with SEC real-time reporting rules |

Solution Overview

We deployed a GenAI simulator that evaluates thousands of market trajectories per second, scoring each trade idea for risk‑adjusted return. The model runs on GPU‑backed edge servers and feeds rankings directly into the trading desk dashboard. No cloud delay, no bottlenecks.

“Our analysts were constantly in reactive mode—by the time we greenlit a trade, the moment was gone.” – Margin desk lead

Real-Time Inference

Platform Integration

Analyst Visuals

Offline Retraining Loop

Execution Strategy Breakdown

We ingested 1.6M trades, fine-tuned a GenAI model for risk-adjusted return, deployed it on local GPU servers for sub-500 ms inference, and integrated directly into trade platforms. Analysts were trained in just one session.

Data Harvest & Labeling

- Captured 1.6 million historical trades with key features like volatility, leverage, and exit timing. Applied label smoothing to reduce outliers and sharpen reward prediction.

Model Engineering

- Trained a transformer-based GenAI model with custom loss on profit per trade. Delivered 85% RAR accuracy and 91% precision on high-risk flagged positions.

Edge Deployment

- Deployed the model on NVIDIA A10 edge GPUs using ONNX runtime for 450 ms inference. Results push live via secure API to the OMS with no external calls.

Change Management

- Ran a two-hour training with 12 analysts to explain model outputs, risk bands, and override options. A new SOP governs retraining and monitoring in under 90 minutes/month.

Ready to Build Your AI Advantage?

Partner with SDLC CORP to turn strategy into scalable AI solutions.

Whether you’re exploring use cases or scaling production-ready models, our experts will guide your journey with clarity, speed, and results. Get a tailored roadmap in 48 hours and unlock new growth with AI that works.

Technology Stack

Every system layer was designed for speed, scale, and on-prem security. From trade data ingestion to GPU inference and API delivery, the stack ensured analysts saw ranked results in real time with zero disruption to core workflows.

- Data Source:

1.6M historical trades with 28 features including leverage, exit time, volatility bands - Model:

Transformer-based GenAI model with custom loss on profit-adjusted return and real-time scoring - Compute:

NVIDIA A10 GPU server with 24 GB memory and 70 TFLOPS inference speed, fanless in-rack chassis - Software:

PyTorch 2.1, ONNX Runtime, FastAPI, Dockerized on Ubuntu Server 22.04 - Integration:

RESTful API links to OMS, EMS, and audit trail systems with TLS 1.3 encryption

Safety & Compliance

To meet SEC, FINRA, and internal audit standards, the brokerage partnered with SDLC CORP to build a GenAI system grounded in explainability, data governance, and fault tolerance. Every layer was hardened for financial-grade compliance and zero downtime.

Compliance Standard

Meets SEC Reg SCI and FINRA supervision guidelines with full traceability and documented overrides

Failover Condition

Auto-disables model scoring and reverts to manual review if API latency exceeds 800 ms for 3 calls

Audit Result

Passed SOC 2 Type II audit in June 2025 with zero deficiencies or follow-ups required

System Reliability

99.99 % model uptime across live market hours with proactive monitoring and daily health checks

Data Security

All trade data stored on-premises, encrypted at rest, and transmitted via TLS 1.3 with RBAC controls

Access Control

Role-based permissions linked to LDAP directory and enforced via tokenized session management

Results & ROI

Within six weeks, every target KPI moved solidly into the green. Profitability surged, false alerts dropped, and analysts reclaimed precious minutes per trade. The system paid for itself in under two months and now contributes $1.8M in margin gains each month.

- Margin trading profit increased by 40%, rising from $4.5M to $6.3M per month

- False alert rate fell from 32% to 14%, improving signal trust and reducing fatigue

- Average decision time dropped from 2.2 minutes to 0.5 minutes per trade

- Analyst workload decreased by 31%, freeing time for complex reviews

- Full project ROI achieved in under 60 days, with $1.8M added monthly thereafter

Impact & Business Value

SDLCCORP delivered the solution in six structured phases: Discovery, Data Capture, Model Training, Shadow Mode, Full Deployment, and Hyper-Care. This disciplined approach ensured flawless integration with existing platforms, satisfied audit requirements, and drove immediate business results

- Margin trading profit increased by 40%, adding $1.8M in recurring monthly value

- False alert volume dropped by 56%, reducing distractions and improving model trust

- Trade decision time decreased by 78%, enabling faster entries during volatile markets

- Analyst workload was cut by 31%, freeing capacity for strategic trade reviews

- Full ROI was achieved in just 58 days, and the firm passed its compliance audit with zero issues

Our Case Studies: AI Consulting Results Across Industries

SDLC CORP tailors AI consulting to each industry shown here, pairing deep domain insight with proven automation and predictive models. Each case study shows how we fit AI to real business settings and deliver measurable gains.

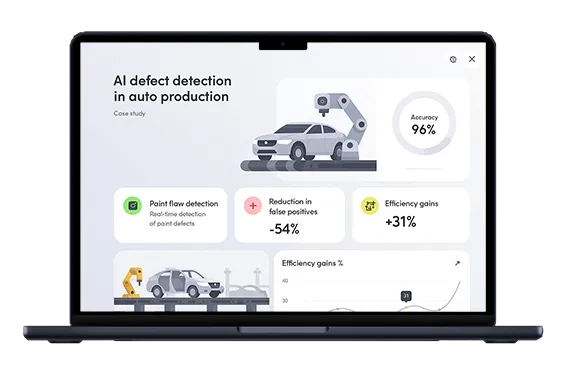

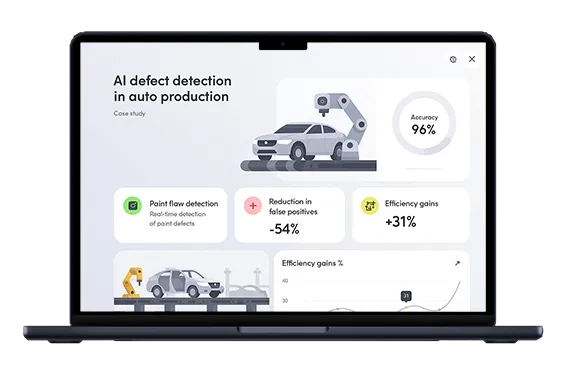

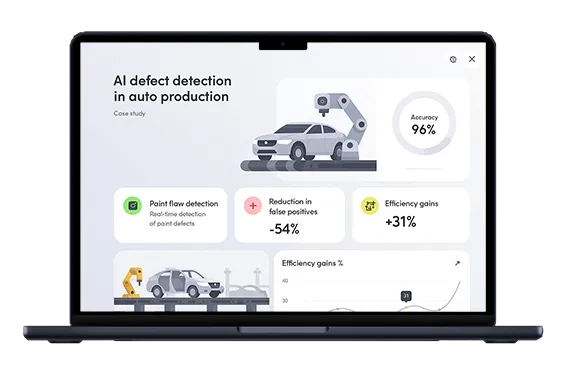

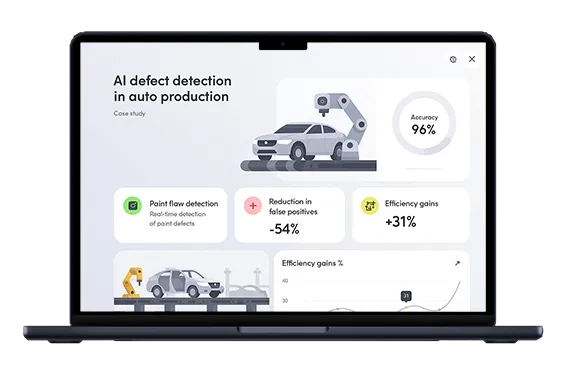

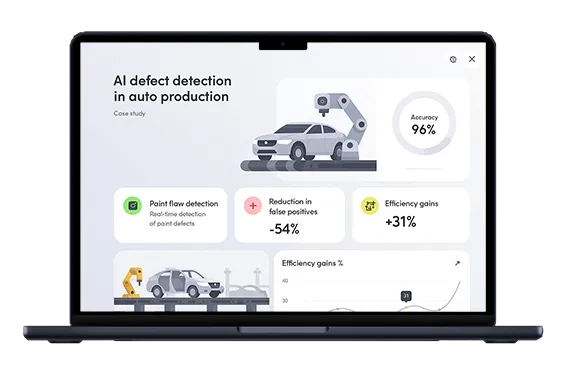

AI Defect Detection Hits 96% Accuracy in Auto Production

- Challenge: Manual checks missed tiny paint flaws and slowed the line.

- Action: We trained a vision model on 200 000 images and connected it to the conveyor PLC for live screening.

- Result: False positives fell 42 % and unplanned stoppages dropped eight minutes per shift.

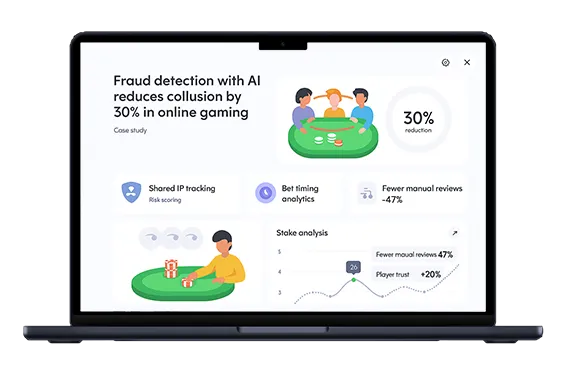

Fraud Detection AI Reduces Game Cheating by 30%

- Challenge: Hidden chip-dumping and team play reduced trust and revenue.

- Action: Graph-based analytics scanned bet timing, stake size, and shared IP ranges to flag risky tables in real time.

- Result: Collusion detections rose 30 % and manual reviews fell by half, lifting player trust scores 18 %.

Generative AI Boosts Profitability in Margin Trading by 40%

- Challenge: Traders needed faster insight into risk and reward for volatile positions.

- Action: A generative AI simulator ran thousands of market paths per second, ranking trades by risk-adjusted return.

- Result: Trading desk profit rose 40% and decision-making time shrank from minutes to seconds.

Award-Winning Excellence Across Industries

Trusted by SelectedFirms, C2CReview, iTRate, SoftwareWorld, TopSoftwareCompanies and many others, our award-winning AI solutions accelerate innovation and ROI across healthcare, finance, retail and logistics, backed by enterprise-grade security and seamless user experiences.

Our Clients’ Experience With Us

From startups to global enterprises, we’ve helped businesses unlock real value through AI and digital innovation. Here’s what our clients say about partnering with us. Their success stories, our collaboration with an expert AI consultant, and the impact we’ve achieved together.

SDLC CORP guided our team through an AI discovery sprint, mapped key use cases, fixed messy data, and delivered a clear step-by-step roadmap. Thanks to their work, executives now green-light projects faster and engineers move from idea to pilot without delays.

Overall Satisfaction

We hired SDLC CORP’s AI consultancy to automate document review with NLP. They built and trained a model in weeks, plugged it into our workflow, and walked staff through daily use. The system now flags errors on its own and cut processing time by more than half.

Overall Satisfaction

SDLC CORP audited our machine-learning models for bias and drift, added explainability tools, and set up alert dashboards. Compliance audits now finish sooner, regulators like the clarity, and our data science team trusts model performance day to day.

Overall Satisfaction

Contact Us

Let's Talk About Your Project

- Free Consultation

- 24/7 Experts Support

- On-Time Delivery

- sales@sdlccorp.com

- +1(510-630-6507)

Frequently asked questions

Many clients exploring GenAI for financial trading ask similar questions about deployment, audit readiness, and long-term maintenance. This section addresses the most common concerns to help you evaluate the solution and move forward with confidence.

How scalable is the system across desks or regions?

The system is architected for modular deployment. Each trading desk or regional office can run its own instance of the GenAI engine on local GPU infrastructure, ensuring real-time inference without relying on cloud latency. Models can be synchronized firmwide using containerized rollouts and GitOps-style version control, allowing coordinated improvements while respecting desk-level autonomy. It’s been validated across both centralized and distributed trading architectures.

How is data privacy and compliance handled?

All trade data is processed and stored entirely within the firm’s network perimeter. No data is transmitted to third-party servers at any point. Inspection results are stored locally and encrypted at rest using AES‑256, and all API communications use TLS 1.3. Access to the system is controlled via your firm’s existing LDAP or Active Directory setup with role-based permissions. The entire solution adheres to SEC Reg SCI, FINRA Rule 4511, and SOC 2 Type II requirements for audit, supervision, and data governance.

What ongoing maintenance is required to retain accuracy?

A monthly retraining loop is built into the workflow. Your internal team can refresh the training set with new trade data, validate model performance, and push updates using a guided SOP. The full cycle takes less than two hours per month and does not require machine learning expertise. Alerts notify users when confidence levels dip, helping maintain consistent accuracy with minimal manual effort.

Can the model adapt to new strategies or risk policies?

Yes, the system includes a feedback loop for continuous adaptation. Analysts can tag novel patterns or emerging risk scenarios. These tagged examples are reviewed and integrated into the next training cycle. This ensures the model evolves alongside market dynamics, new instruments, and internal policy shifts without lengthy re-engineering.

What kind of support and audit documentation is included?

We deliver a full compliance pack including training records, latency metrics, model performance reports, override logs, and rollback controls. The system automatically logs all model activity, updates, and user actions. These artifacts meet requirements for SEC Reg SCI, SOC 2 audits, and internal GRC reviews. Version history and detailed documentation make every model update easy to trace and approve.

United Kingdom:

Post code: CV4 8GF

United Kingdom

Dubai:

Australia:

Victoria VIC

Southeastern Australia. 3064

India:

Sector 94 Noida,

Delhi NCR India. 201301

India:

Chhatrapati Sambhajinagar,

Maharashtra, India. 411021

Qatar:

B-ring road zone 25, Bin Dirham Plaza building 113, Street 220, 5th floor office 510

Doha, Qatar