In today’s fast-paced financial world, banks face challenges like rising customer expectations and strict regulations. Odoo ERP offers a customizable solution that enhances customer experience and strengthens risk management. This blog explores how Odoo ERP can transform banking operations.

Odoo is an open-source ERP platform with modular business apps like CRM, sales, and accounting. Its flexibility lets banks customize solutions for customer management, compliance, risk assessment, and data analytics.

Why Choose Odoo for Banking?

- Open-source and customizable: Tailor workflows to unique banking needs

- Integrated apps: Streamline multiple banking functions on one platform

- Cost-effective: Affordable licensing and low total cost of ownership

- Scalable: Supports growth from small banks to large financial institutions

- Strong community and support: Access to continuous updates and new modules

Importance of Customer Experience in Banking

Customer experience (CX) is now a key differentiator in banking. With digital-first customers expecting seamless, personalized services, banks must go beyond traditional models to stay competitive.

1. What Defines Customer Experience in Banking?

- Convenience: Easy access to banking services through multiple channels

- Personalization: Customized financial products based on customer profiles

- Speed: Fast loan approvals, transactions, and query resolutions

- Transparency: Clear communication of terms, fees, and processes

- Security: Confidence that customer data and transactions are safe

2. Why CX Matters for Banks?

- Customer retention: Happy customers stay loyal and bring referrals

- Revenue growth: Improved cross-selling and up-selling opportunities

- Brand reputation: Positive experiences build trust and attract new clients

- Operational efficiency: Satisfied customers require less support

Challenges in Banking Risk Management

Risk management is equally crucial. Banks face a spectrum of risks that can threaten their financial stability and reputation. Effective risk control protects the institution and its customers while ensuring regulatory compliance.

Common Risk Challenges

- Credit risk: Defaults on loans and credit facilities can impact financial health.

- Operational risk: System failures, fraud, and human errors disrupt services.

- Compliance risk: Failure to meet regulatory mandates can lead to fines and penalties.

- Market risk: Volatility in interest rates, currency, and investments can affect earnings.

- Cybersecurity risk: Increasing threats to data privacy and IT infrastructure.

Banks need integrated systems offering real-time analytics and alerts to detect, assess, and mitigate these risks proactively.

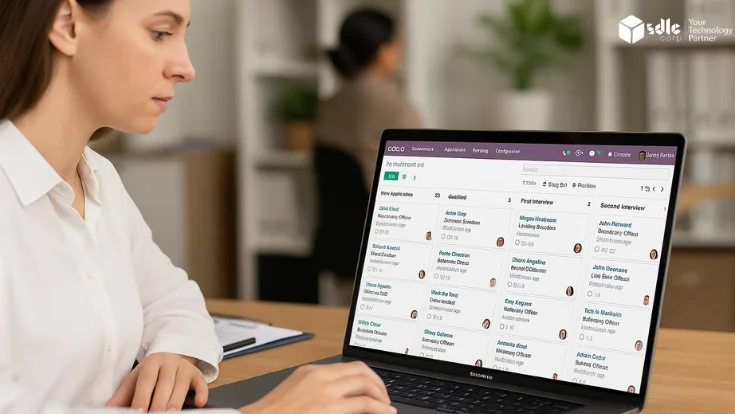

How Odoo ERP Enhances Customer Experience

Odoo ERP offers features designed to directly improve banking customer experience:

- Centralized customer data management for unified insights

- Personalized marketing and targeted product offers

- Omnichannel customer support for seamless communication

- Integration with online banking platforms for convenience

- Automated workflows to speed up loan approvals and transaction handling

Role of Odoo ERP in Risk Management

Odoo ERP strengthens risk management by embedding tools and workflows to monitor, control, and respond to risks effectively:

- Real-Time Risk Analytics: Dashboards and alerts provide instant insights into credit, operational, and market risks.

- Compliance and Audit Trails: Automated tracking of regulatory requirements and comprehensive audit logs simplify reporting.

- Workflow Automation: Enforces risk controls and approval processes, reducing human errors.

- Fraud Detection and Alerts: Monitors suspicious activities and triggers notifications for timely intervention.

- Disaster Recovery and Data Security: Ensures data integrity and availability with backups and encryption.

This integrated approach helps banks stay compliant, secure, and resilient against evolving threats.

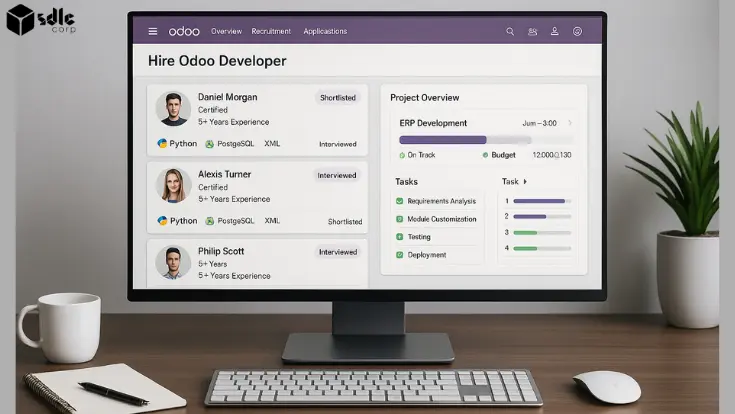

Key Modules of Odoo ERP for Banking

Banks can pick and choose modules based on their specific needs:

- CRM (Customer Relationship Management)

- Accounting and Finance

- Loan Management

- Helpdesk and Customer Support

- Marketing Automation

- Risk and Compliance Management

- Document Management

Real-World Use Cases

Case 1: Digital Bank Improving Customer Retention

A regional digital bank implemented Odoo CRM and Marketing Automation to analyze customer behavior and send tailored product recommendations, leading to a 25% increase in cross-sell conversions and a 15% boost in customer retention within six months.

Case 2: Mid-Sized Bank Enhancing Risk Controls

A mid-sized bank deployed Odoo’s Accounting and Risk Management modules to automate loan approval workflows and compliance reporting, reducing manual errors by 40% and accelerating audit processes, improving regulatory compliance.

Read real-world success stories of banking clients: Case studies Odoo ERP solutions

Implementation Best Practices

To successfully leverage Odoo ERP in banking:

- Assess Needs Thoroughly: Identify modules that align with your goals.

- Customize Wisely: Tailor workflows without overcomplicating processes.

- Train Staff: Ensure employees understand how to use the system efficiently.

- Integrate Securely: Connect Odoo with existing banking software while maintaining data security.

- Monitor and Optimize: Use analytics to continually refine customer and risk management strategies.

Discover how SDLC Corp provides end-to-end: odoo-implementation

Conclusion

Odoo ERP offers a powerful, flexible solution for banks aiming to elevate customer experience and strengthen risk management. By centralizing data, automating workflows, and enabling real-time insights, Odoo helps financial institutions navigate the evolving banking landscape with agility and confidence.

Banks that embrace such integrated ERP systems will not only meet but exceed customer expectations while maintaining robust control over risks—setting the stage for sustainable growth in a competitive market: expert Odoo consulting

Contact us SDLC CORP

FAQ's

1. What is Odoo ERP and How is It Relevant to Banking?

Odoo ERP is an open-source, modular enterprise resource planning system. It streamlines core banking functions such as CRM, accounting, loan processing, compliance monitoring, and risk management.

2. How Can Odoo ERP Improve Customer Experience in Banks?

Odoo ERP centralizes data, enables personalized marketing, speeds up service delivery, and supports multi-channel communication for tailored customer service.

3. What Risk Management Features Does Odoo ERP Offer?

It offers real-time risk analytics, compliance monitoring, fraud detection, audit trails, and workflow automation to enforce controls and reduce errors.

4. Is Odoo ERP Secure for Financial Data?

Yes, it supports role-based access control, encryption, audit logging, and can be deployed on secure infrastructure meeting regulatory standards.

5. Can Odoo ERP Be Customized for Different Banking Workflows?

Absolutely. Its modular and open-source nature allows extensive customization to fit retail, corporate, or investment banking workflows.

6. What Are the Main Odoo Modules Used by Banks?

CRM, Accounting, Loan Management, Helpdesk, Risk & Compliance, Marketing Automation, and Document Management.

7. How Does Odoo Compare to Traditional ERP Systems?

Odoo is more flexible, cost-effective, scalable, and easier to deploy, avoiding the bloat often seen in traditional ERPs.

8. How Long Does Odoo ERP Implementation Take in a Bank?

Typically between 2 to 6 months, depending on the bank’s size and selected modules.

9. Can Odoo Integrate With Existing Banking Software?

Yes, Odoo offers APIs and integration support for core banking systems, payment gateways, and analytics tools.

10. What Support is Available Post-implementation?

SDLC Corp offers training, performance optimization, upgrades, and ongoing support to ensure smooth operations.